|

KBR presented at Baird’s 2018 Government Services and Defense Conference. Highlights from their presentation include:

0 Comments

H.I.G. Capital has acquired Iron Bow Technologies, according to this press release from the investor. This will be H.I.G’s third government services platform.

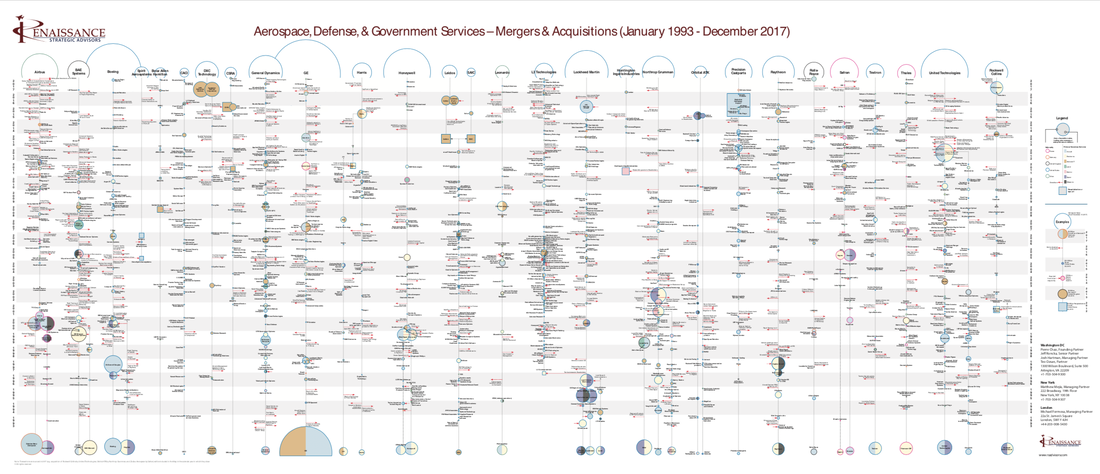

Iron Bow delivers IT solutions to the government, industrial, and healthcare markets. Oddly appropriate that 14 years of defense industry M&A fits on a single slide:

Renaissance Strategic Advisors updates industry M&A infographic Experienced Federal contracting CEO Andrew Maner has led the acquisition of The Sentinel Company for NewSpring Holdings. “In just over four years, NewSpring Holdings adds its fourth platform with Sentinel, a Washington, DC-based government services and solutions firm founded in 2005. Clients of Sentinel include agencies and industry partners in border security, national security, Department of Defense, and federal health.” Maner previously led DC Capital backed National Interest Security Company (NISC) through its eventual sale to IBM.

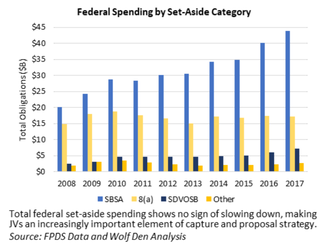

Opportunities for small business contractors of all categories are growing, both in the U.S. and for OCONUS programs. In addition to international opportunities previously mentioned, some agencies with growing budgets, like Special Operations Command, historically prefer small businesses. SOCOM will spend in excess of $3 billion with contractors in FY18… The Command’s emphasis on small business (historically a third of contracts) has led to the development of a strong lower middle market base of emerging, mission-focused solutions providers. Aronson Capital Partners Summer 2018 Market Pulse Despite clear growth opportunities, many retiring or transitioning owners looking to sell their small business contracting companies face limited exit opportunities for a few main reasons:

Of course, these small but highly capable mission-focused solution providers are extremely sensitive to reputation, legacy and potential disruptions to the ongoing business, given the important work they are doing in the public interest. FRAMCOR is addressing this problem through its investment focus on designated small business professional services contractors. Learn more about our detailed strategy and investment criteria.  A recent analysis by consulting firm Wolf Den Associates shows the dramatic growth in U.S. Government contracting small business set-asides. From $20B total in 2008 to over $50B expected in 2018. Total small business contracting has grown to just over $100B in 2017. Close to 70% of this spending will be for professional services, including information technology, engineering, and other technical services. Originally proposed in 2016, it is expected in Q1-2019 the FAR will change to extend small business contracting fully to OCONUS contracts.

“In its final rule, SBA has clarified that, as a general matter, its small business contracting regulations apply regardless of the place of performance. In light of these changes, there is a need to amend the FAR both to bring its coverage into alignment with SBA’s regulation and to give agencies the tools they need especially the ability to use set-asides to maximize opportunities for small businesses overseas.” (FAR Case 2016–002, Applicability of Small Business Regulations Outside the United States) This is a great opportunity for all categories of small business, and a stronger mandate for large contractors to seek out capable small businesses on their OCONUS teams. |

Our ideasLatest FRAMCOR news and ideas on global defense and government contracting, major programs, strategy, talent management, M&A, and more. Archives

July 2019

Categories

All

|

RSS Feed

RSS Feed