|

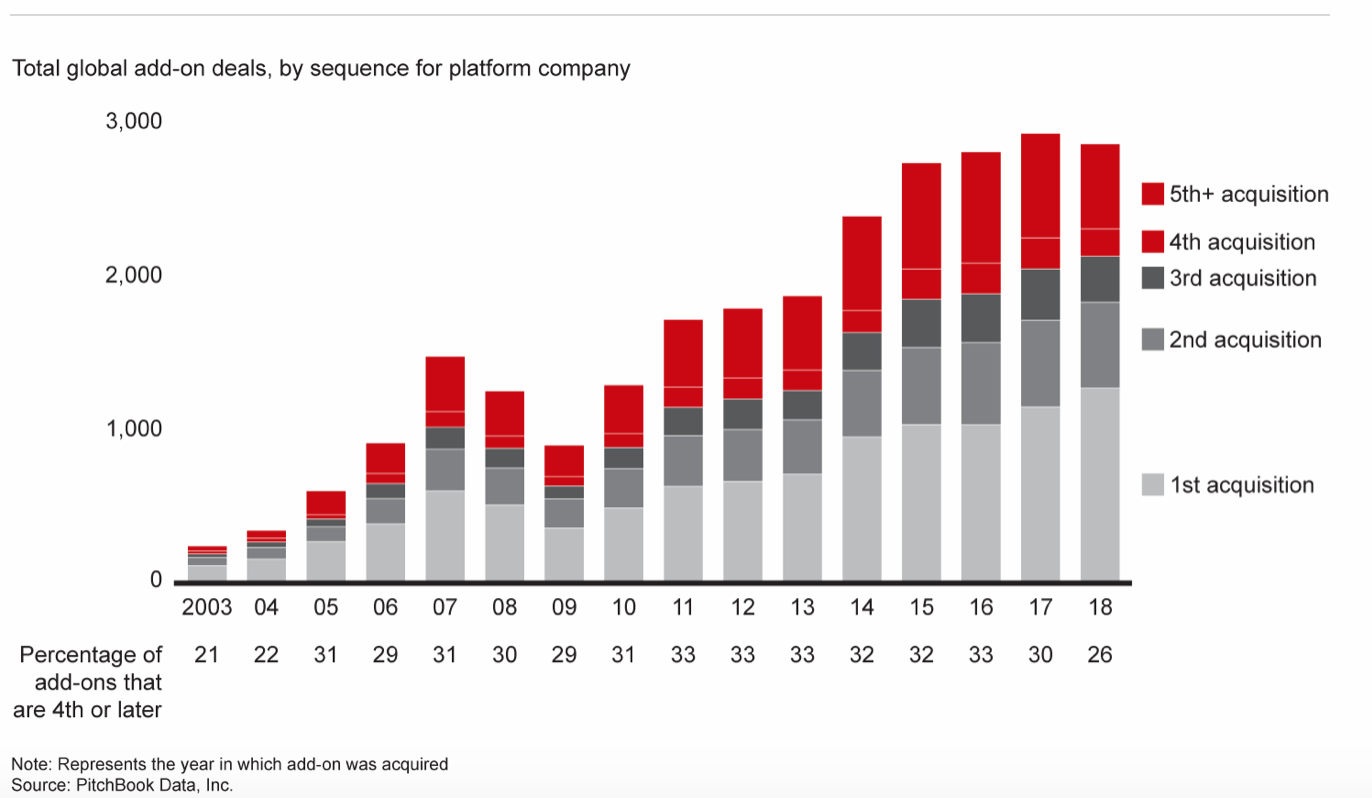

An article on Axial points to growing value from buy and build strategies. The article quotes Gretchen Perkins from Huron Capital: "Pursuing a buy-and-build strategy and employing add-on acquisitions is a solid way to achieve above market growth and shareholder value in a 3% GDP environment” In growing markets with fragmented competitor landscapes, PE investors increasingly employ a buy and build strategy by first acquiring a "platform" company -- typically a larger company with established management team and operations -- and then add smaller acquisitions that tend to trade at lower multiples compared to larger companies. Bain Capital's 2019 Global Private Equity Report further defines the buy and build strategy not as just doing a couple add-ons, but a deliberate strategy with a steady pace of acquisitions: "We define buy-and-build as an explicit strategy for building value by using a well-positioned platform company to make at least four sequential add-on acquisitions of smaller companies." And increasingly, add-on details are part of an overall strategy based on M&A, as evidenced by the following table:

0 Comments

Leave a Reply. |

Our ideasLatest FRAMCOR news and ideas on global defense and government contracting, major programs, strategy, talent management, M&A, and more. Archives

July 2019

Categories

All

|

RSS Feed

RSS Feed